Contents

AvaTrade was founded in Dublin, Ireland, in 2006 by Emanuel Kronitz and Negev Nosatzki. The firm began operations as forex trading firm Ava FX, but soon branched out into other asset classes. AvaTrade is regulated by several well-respected international regulatory bodies. All of the below bodies provide protection over clients’ funds by ensuring they are kept in separate bank accounts.

AvaTrade provides its traders with access to more than 50 forex pairs, including all the major currency pairs, minors and exotics. AvaTrade offers customers dedicated 24/5 customer support in 15 languages. Traders can contact the AvaTrade customer service support team by phone, email, and live chat.

Research from AvaTrade

I use them myself and have always been happy with everything from funding my account, customer support to an enjoyable trading experience with any hassle. The service, combined with a deep understanding of the financial markets, allow traders to enter the markets with confidence. These tools can help with analysing potential trading opportunities and improve your overall trading experience. Most traders could probably make do with the tools already included with the platforms but it is nice to have more available.

The webpage has an online form if you’d like to contact the firm, including the reason for request, name, email, phone number, subject and official request. AvaTrade charges an administration fee of $100 after 12 consecutive months of non-use. Spot opportunities, trade and manage your positions from a full suite of mobile and tablet apps. This commission is deducted directly from the funds in the client’s account and will be applied for each period of inactivity .

As per the web trader registration, traders are asked to fill in a set of personal and experience-related details. Demo account traders are not required to complete the verification process. In order to withdraw funds, traders need to fill out a withdrawal form through MyAva. Traders must verify their account to be eligible for withdrawals. However, Avatrade does not conduct seminars or live webinars. Seminars and webinars are a great way for beginners to interact with professional traders and polish their skills by asking questions.

The spreads will be determined by the different financial instrument that is being traded. Traders can expect from 0.03 on bonds, 0.3 pips on Indices, 0.34 on commodities, 0.9 on FX Options and Forex if only to name a few. Traders who are eligible for the Islamic account can follow the process of opening an AvaTrade live account and apply for the Islamic option after funding their trading account. AvaTrade claims that the withdrawal process takes 1-2 working days . The arrival time of funds depends on the payment method used for your withdrawal. The fastest withdrawals are usually processed via credit and debit cards, or via e-wallets like Neteller and Skrill.

Trading Central’s proprietary technology is grounded on technical reviews which are based on psychological market behaviour. Its algorithms are programmed to accurately track the formation of tradable chart patterns and Fibonacci levels, as well as develop opportunities based on the Elliot Wave Theory. Whether you are a new or experienced trader, Trading Central can be of great benefit to assist with fast and efficient market analysis. The platforms are fully customisable, so you can make them as complex or simplified as you like, depending on your trading style.

The application form can be completed on the website by providing basic information such as first name, last name, email and phone number. Alternatively, AvaTrade allows logging in using Facebook or Google. Once personal details are verified, the account can be funded and used. Swap commission is also called overnight premium because it is charged at night. We can only say that, when trading with AvaTrade, you can find the spread as a difference between the bid and in other ways that we will explain below.

AvaTrade Broker Fees

Traders also have automated trading platform choices including ZuluTrade, which can be integrated into MT4, downloaded as an app or traded over the web. On the downside, Avatrade, despite providing cryptocurrency trading, does not accept or provide funds in cryptocurrencies. This could be a disadvantage for traders, who quite frequently use cryptocurrencies as a means of payment. DupliTrade is an MT4 compatible platform which allows traders to automatically copy trading strategies in real time according to their risk preference and trading style.

A standard account opens with just USD 100 using credit cards or with USD 500 in case of a wire payment. The vital features like Watchlist, Charting, and Fast Trade Entry are easy to use in the mobile application. You can log in to your account, and view all the account details, and have the privilege of a wide range for trading.

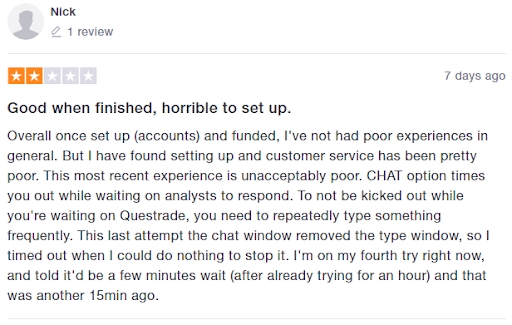

Online brokers, according to their type, offer fixed spreads or variable spreads to their clients. In some cases, the broker offers both fixed or floating spreads depending on the type of trading account the trader selects. Avatrade took over 6000 pounds from me due to faulty log outs and other issues that never got resolved. They offered 10 times to get my account manager to call me who never called or even attempted to call. Avatrade is the biggest scam out there and shouldn’t be referred to as a regulated broker because this app is designed to lose.

In the case of a deposit made via a third party, that is not a credit card payment method, you must withdraw 100% of the deposit transaction on this initial payment method. It is a pleasure to trade from, although perhaps lacking in advanced tools compared to some of the leading desktop platforms such as MetaTrader 5 and cTrader – which you can use with Purple Trading. I found it very easy to load charts in each of the platforms and add my indicators to analyse the markets.

- They also allow multiple trading platforms, such as Meta Trader 4 and AvaTrade Go .

- On the other hand, if you perfect a broker’s proprietary platform and then leave, you will need to start from scratch with another platform.

- Apart from this, AVATrader imposes no extra fees on any deposits or withdrawal.

- Apart from these, AvaTrade also allows trading on FX Options, Indices, Bonds, and ETFs.

AvaTrade also offer a selection of copy trading software to copy trades of other traders, DupliTrade and ZuluTrade. Now you can enjoy the charge-less withdrawal and deposit options. There are also a lot of user-friendly tools for research available. It has something to offer to all kinds of traders, let the trader be a beginner or a seasoned veteran. AVATrade provides all types of trading on the MetaTrader 4 and MetaTrader 5 platforms. Account opening requires a minimum deposit of $100 if the deposit is made through credit card or wire transfer.

Demo Account With 21 Day Trial

AvaTrade charges broker fees, while deposits and withdrawals are free of charge. 78% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. AvaTradeGO trading app https://broker-review.org/ is an exceptional end-to-end solution for anyone in the UK interested in the world of CFD trading for forex, shares, indices, commodities, and so much more. Plus, exclusive to AvaTrade – 🛡️ Protect your trades with AvaProtectTM, the ultimate built-in risk management.

Before you can withdraw your money from AvaTrade, you need to ensure that your AvaTrade account and identity have been fully verified and confirmed by the AvaTrade team. After verification, the withdrawal process on Avatrade’s side takes 1-2 working days, although your funds may take longer to arrive due to banking policies. Traders can execute, and manage FX and options trades on-the-go with 13 different options strategies available. The broker offers both fixed and variable spreads depending on the specific market being traded. TradingBrokers.com is for informational purposes only and not intended for distribution or use by any person where it would be contrary to local law or regulation.

AvaTrade makes its money off the cost of opening and closing a trade reflected in a spread. Spread is variable in nature and differs from asset to asset. They also allow multiple trading platforms, such as Meta Trader 4 and AvaTrade Go . AvaTrade provides a comprehensive summary of fees along with a spread list which can be found under the Trading Conditions & Charges section on the website.

AvaTrade Fees and Spreads

AvaTrade will not approve withdrawal requests until all requirements are met. After you have withdrawn up to 200% of your initially deposited funds to your funding card, you may choose other methods to withdraw the rest of your funds. Traders who fall below the AvaTrade margin requirements risk receiving a margin call and having their position closed prematurely.

If you enjoy working for yourself and understand how to engage in marketing over the internet, then step up and join AvaTrade’s Exclusive Partners Programme. FOREX.com, registered with the Commodity Futures Trading Commission , lets you trade a wide range of forex markets plus spot metals with low pricing and fast, quality execution on every trade. We’ve also got a list ofthe top stock trading schools,online stock trading coursesyou can start now andself-paced modules to teach you about forex.

These are the most common commissions you can find if you trade with the AvaTrade broker. AvaTrade trading account is subject to commission if it is kept inactive. If a short position is held, 100% of the dividend will be debited from the trading account .

AvaTrade is an award-winning trading broker with regulations in multiple jurisdictions offering a generous selection of over 1250+ trading instruments across various markets for you to trade. I would regard AvaTrade as one of the best trading brokers for many reasons that I will outline within this AvaTrade review. In my years of having an account with them, I have never had any problems.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Users get a total of 100,000 demo currency credits to test the platform with. AvaTrade is an online brokerage firm offering its global customers access to forex and Contracts-for-Difference trading in shares, bonds, indices, ETFs, commodities, and cryptocurrencies.

These are the standardized monetary payment options that are accepted by AvaTrade. Besides, there are a number of regional payment options also which you can avail. Hence, to sum up, the payment methods are very diversified and vary according to your location. After the verification process, your account would be ready.

Wire transfers may take the longest up to 10 days after processing. Given that the page is split into asset browsing and charting, it has a simple and uncluttered design. The top-bar shows overall account balance statistics, like the available and total balances, along with the trader’s profit/loss and equity data. The AvaTrade web trader’s dashboard welcomes traders with a shortcut menu on the left-hand side, offering tabs like trading, position management, open orders, and order history.