Contents:

F. Finally, enter in the loan balance as the “Opening Balance”. B. Once you arrive at the Banking tab, select the “Add Loan” option. This feature allows you to add a loan to your QuickBooks account. Information provided on Forbes Advisor is for educational purposes only.

Enter the name of the liability account you created to track the loan in the field in the “From Account” column. Type the loan amount in the field in the “Amount” column. The way QuickBooks handles this is with a special account called Undeposited Funds, which I think of as the drawer in your desk where you put checks until you deposit them. It might be that you make a deposit every day, but even then, throughout the day, when checks or cash comes in from customers, you put them in your drawer until you make that deposit.

QuickBooks allows you to access almost all types of accounts, including but not limited to savings account, checking account, credit card accounts, and money market accounts. To start recording customer payments, you will record a new bank deposit. Click on the New button in the left-side Navigation Pane and choose Bank Deposits from the Other category. In the Category Details for each check, select the liability account for the loan on the first line in the Category column. Enter the payment amount in the Amount category.

How Should I Set up the Escrow Account?

If you use Direct Withdrawal or EFT, enter Debit or EF in the Check #field. In the second line, choose the asset column appropriately from the Account drop-down. First of all, start making a new bank deposit by clicking the New button in the left-side Navigation Pane and choosing Bank Deposit under the Other heading.

online loan company scams -【person of interest 5 free 】 – Caravan News

online loan company scams -【person of interest 5 free 】.

Posted: Mon, 24 Apr 2023 19:29:36 GMT [source]

Next, enter the account that you made to track the loan as the off setting account in the area below the check and also enter the amount. At the Chart of Accounts, click the New button to start a creating a new account. In the Account panel that pops up, choose Other Current Assets for the Account Type. This type of loan should be paid back before the end of the fiscal year. You will need to enter information on two lines in the Journal Entry. On the first line, select the customer’s loan account from the Account dropdown.

Select “Chart of Accounts” from the “Lists” menu at the top of the screen and click “New.” Then choose “Long Term Liability” from the “Type” drop-down list. You’ll need to set up accounts for your mortgage principal, interest and escrow payments, if applicable. In QuickBooks Online, you can set up a liability account to record the loan and its payments. When the insurance and tax payments are due, your lender will make the payments. Then, reduce your escrow account by the amount paid to the tax assessor and insurance company.

You’ve now seen how to what is internal control in accounting many facets of receiving and making loans. To start this, click the New button in the left-side Navigation Pane and choose Receive Payment under the Customer heading. Now that you’ve seen how to record a loan that you have received, let’s look at how you can grant loans to others. Enter a check number if you are sending a check, or enter Debit or ETF in the Check field if you are using direct withdrawal or an ETF.

How to Collect Money Owed from Past Tenants

Mortgages payments are typically calculated using an amortization calculator. Each payment made towards paying down the mortgage is broken down between an interest component and a principal repayment component. If you don’t see your needed “Lender,” you can create it within QuickBooks Desktop’s Vendor Center.

It’s important to understand the basics of how to set up a loan in QuickBooks in order to ensure that your financial records are accurate and up-to-date. In this blog post, we’ll provide a step-by-step guide on how to set up a loan in QuickBooks, from creating the loan account to entering the loan details. We’ll also discuss the different types of loans available and how to manage them in QuickBooks.

How to Open an Escrow Account for Rent Deposits

This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. Additional information and exceptions may apply. Applicable laws may vary by state or locality. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Gentle Frog, LLC does not have any responsibility for updating or revising any information presented herein.

An escrow payment with regards to a mortgage is simply money given to another party to hold until certain payments, such as home insurance premiums and tax payments, are due. By telling you to pay $200 a month the bank has now effectively forced you to save $2,400 to these yearly expenses. You will need to add a vendor for the bank or financial institution issuing the loan if it does not already exist as a vendor in QuickBooks. Setting up a loan in QuickBooks can be a daunting task, especially for those who are new to the software.

Previously I showed you how to add an equipment loan to QuickBooks Online. Should clear within 90 days of when they were written. If one hasn’t, you need to look into it further to make sure it’s not a duplicate. Details on how to do this are in our Growth Plan’s detailed Control Sheet, visit jordancpaservices.com/GrowthPlan to learn more. Click the Save and Close button to finish the process.

Click the Save and Close button to finish adding this entry to the account. Once at the Chart of Accounts, click the New button to create a new account. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Choose “Expense” from the drop-down list, enter a name for your account, perhaps “Interest,” and click on “OK.”

loan for online courses ✅-【what can happen if i don’t pay my student … – Caravan News

loan for online courses ✅-【what can happen if i don’t pay my student ….

Posted: Mon, 24 Apr 2023 16:03:42 GMT [source]

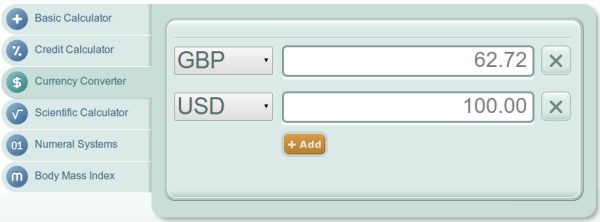

If you operate in multiple international locations QuickBooks allows you to accept payment in local currencies. Of course, it is safer to first check if QuickBooks accepts payment in the currency you deal with. All transactions are recorded automatically as they occur. With QuickBooks, it is very simple to track time as well as billable expenses incurred by employees or subcontractors. They can either enter it themselves using the QuickBooks mobile app or submit it manually and a bookkeeper on your end can enter the details in the app.

For selecting the file, click on “select your file,” Alternatively, you can also click “Browse file” to browse and choose the desired file. You can also click on the “View sample file” to go to the Dancing Numbers sample file. Then, set up the mapping of the file column related to QuickBooks fields.

- It is free from any human errors, works automatically, and has a brilliant user-friendly interface and a lot more.

- Primarily for small businesses and accountants, it allows users to keep track of cash flow, issue and monitor invoices, manage payroll and take credit card payments online.

- Setting up a loan in QuickBooks can be a daunting task, especially for those who are new to the software.

Now that you have an item, it’s time to create the recurring invoice. Then, click the Save and Close button to finish this step. You may want to grant a loan to other companies for several reasons.

small car loan bad credit no money down mesa az ✅-【i need … – Caravan News

small car loan bad credit no money down mesa az ✅-【i need ….

Posted: Mon, 24 Apr 2023 19:24:29 GMT [source]

Setting up the escrow account is fairly straight-forward once you know the basics. And, there are many ways to accomplish the same thing. For more information on setting up your recording your mortgages correctly, check out this video and blog.

Some businesses occasionally need to borrow money to fund capital investments such as new premises, equipment or product research and development. When your company borrows money, you should record the loan as a liability in your accounts and track each loan payment that you make to reduce the liability. With QuickBooks business accounting software you can set up a liability account for a short-term or long-term loan to record and track the loan deposit amount and all loan repayments. Quickbooks is an accounting program developed and sold by US software company Intuit. Primarily for small businesses and accountants, it allows users to keep track of cash flow, issue and monitor invoices, manage payroll and take credit card payments online. Along with all this, it lets users stay on top of outstanding mortgages they owe.

- Outsourcing your bookkeeping is more affordable than you would think.

- We can do this by creating a new journal entry.

- Simply put, an escrow account is a way for you to put a little money aside each month to cover taxes and or insurance for when they are due.

- In the next screen enter the “Due Date of Next Payment”, “Payment Amount”, the “Next Payment Number” defaults to “1”, enter “Payment Period”, and select “Next”.

- You can get to the Chart of Accounts by clicking on the Settings icon in header and then choosing Chart of Accounts from the Your Company category.

- If you decide to use the money right away to make a purchase and not put it in a bank account, reach out to your accountant.

Select “Other Current Asset” from the drop-down list, enter a name for the account, “Escrow” for example, and complete the “Opening Balance” and “as of” date before clicking “Next”. Select the appropriate accounts from the Category dropdown. Double-click the escrow account to open its Register.

Examples of capital expenses include the purchase of a new computer or the installation of a new roof. Capital expenses are not deductible from your income on your taxes. Dancing Numbers is SaaS-based software that is easy to integrate with any QuickBooks account. With the help of this software, you can import, export, as well as erase lists and transactions from the Company files.